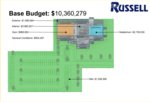

Eldridge council members tonight offer residents their most comprehensive look yet at a $10.4 million fitness center that would finally bring a competition pool to Eldridge.

The estimate prepared by Russell Construction goes $1.7 million higher with an outside recreational pool.

Council members meet at 7:00 p.m. at city hall for a discussion-only session on the project supported so far by the North Scott school district. School leaders have said public financing most certainly will include a voter referendum.

The presentation includes examples of property tax increases required for the plan.

A proposed construction schedule would begin work in March 2020 and open in March 2021.

Here is Eldridge City Administrator John Dowd's memo to council members:

June 12, 2019

To: City council

From: John Dowd

Re: Proposed Y Facility

For the past two years the city has worked in cooperation with the North Scott School District and the Scott County Y studying the concept of building and a jointly-owned recreation facility that would be operated by the Y. The facility would provide fitness activities for all ages, a competition pool for the school district and, possibly a family type pool.

The study committee worked with a design consultant to develop a concept plan for a proposed facility. The results of the effort are stored in the Dropbox folder. Building contractors were contacted to obtain construction estimates after the concept design was finalized. The approximate cost of the facility is $10.4 to $12.7 million. The community pool that is being treated as an alternate to the base project is estimated to cost $1.7 to $1.9 million. The total project cost, including the second pool, could cost $12.1 to $14.6 million. The higher estimate of $14.6 million will be used for this discussion. The school district has recently reserved $7 million for the project in their future development plan. That leaves the city’s responsibility at $7.6 million for the remainder of the project. The remainder of this memo will explore the financing the city’s share of the project.

The only viable means for the city to raise this amount of money is by borrowing the funds by issuing bonds. After accounting for the recent sewer financing, the city has $21.7 million of general obligation bonding capacity available for capital projects. Issuing $7.6 million would leave the city with $13.1 million which is 40% of the 5% debt limit imposed by the state. Using an interest rate of 3.25% as recommended by our financial consultant for a 20-year bond issue annual payments calculates to approximately $460,819. Options for raising the needed funds are as follows:

Option 1. Amend the urban renewal plan and issue urban renewal bonds to be paid with sales tax funds. These bonds would count against the GO debt limit, but they can be issued without a bond referendum. A public hearing would be held to inform the public of the intended action and a resolution authorizing the issue must be passed. The citizens can petition for a referendum is they disagree with the city’s action in this regard. The city’s average sales tax revenue for the past three fiscal years has average $887,590. The bond payment of $481,819 would use about 52% of annual sales tax revenue. When added to the $132,000 already being used for bond payment the city would have committed 67% of annual sales tax revenues to debt reduction for the next eight years.

Option 2. Issue $12.7 million of GO Bonds to be paid back with a property tax levy. This bond issue would require a bond referendum approved by 60% of those voting on

the issue. A bond payment of $480,819 would require a debt levy of $1.12/$1,000 of value. This equates to $112 per $100,000 of taxable value.

Option 3. Split the debt issued between urban renewal bonds and GO Bonds. This approach has at least two benefits. 1) Reducing the reliance on sales taxes to fund the debt leaves more revenue for other projects. 2) Reducing the debt levy on property taxes could make the bond referendum more attractive to voters.

Discussion of the proposed project is tentatively scheduled for June 24th.